The Ultimate Guide To Home Insurance In Dallas Tx

Wiki Article

The Best Strategy To Use For Insurance Agency In Dallas Tx

Table of ContentsHome Insurance In Dallas Tx Can Be Fun For Anyone10 Easy Facts About Home Insurance In Dallas Tx ExplainedLittle Known Facts About Health Insurance In Dallas Tx.What Does Life Insurance In Dallas Tx Do?Home Insurance In Dallas Tx Can Be Fun For EveryoneThe 45-Second Trick For Home Insurance In Dallas Tx

The costs is the amount you pay (normally monthly) in exchange for health insurance policy. Cost-sharing refers to the part of qualified health care expenditures the insurance firm pays as well as the portion you pay out-of-pocket.This type of health insurance policy has a high deductible that you have to satisfy before your health insurance policy protection takes impact. These plans can be ideal for individuals that want to save cash with low monthly costs as well as don't intend to utilize their clinical protection extensively.

The disadvantage to this kind of protection is that it does not satisfy the minimum necessary protection called for by the Affordable Treatment Act, so you may additionally go through the tax fine. On top of that, short-term strategies can omit insurance coverage for pre-existing conditions. Temporary insurance policy is non-renewable, and doesn't include coverage for preventative treatment such as physicals, vaccines, oral, or vision.

The Ultimate Guide To Commercial Insurance In Dallas Tx

Consult your own tax, bookkeeping, or legal consultant instead of relying on this post as tax, accountancy, or legal suggestions.

You can normally "leave out" any type of family participant who does not drive your automobile, however in order to do so, you need to submit an "exclusion form" to your insurance firm. Vehicle drivers that only have a Learner's Authorization are not called for to be provided on your policy up until they are fully certified.

The 8-Second Trick For Health Insurance In Dallas Tx

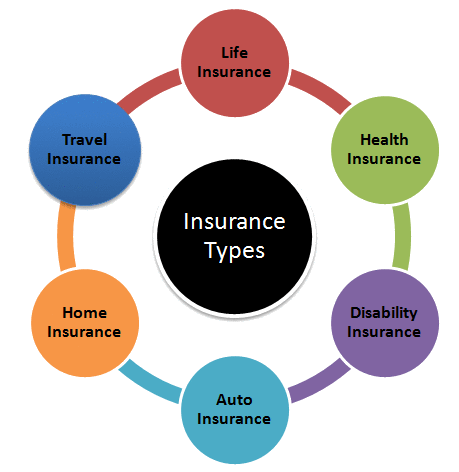

You need to get insurance to safeguard yourself, your household, as well as your riches (Insurance agency in Dallas TX). An insurance plan could save you thousands of dollars in case of a crash, disease, or disaster. As you hit certain life milestones, some plans, consisting of medical insurance and also automobile insurance coverage, are essentially needed, while others like life insurance policy and also disability insurance policy are highly urged.Crashes, health problem as well as catastrophes happen constantly. At worst, occasions like these can dive you into deep economic ruin if you do not have insurance coverage to fall back on. Some insurance plans are inevitable (think: vehicle insurance policy in the majority of US states), while others are just a smart economic decision (think: life insurance).

And also, as your life modifications (say, you obtain a new work or have an infant) so should your insurance coverage. Below, we've clarified briefly which insurance policy coverage you need to highly think about buying at every phase of life. Note that while the plans listed below are prepared by age, obviously they aren't good to go in rock.

Some Ideas on Home Insurance In Dallas Tx You Should Know

Right here's a short introduction of the policies you need useful site and when you require them: The majority of Americans require insurance policy to manage medical care. Picking the plan that's right for you may take some research, yet it acts as your very first line of defense against clinical debt, among largest resources of financial obligation amongst consumers in the US.In 49 of the 50 US states, drivers are called for to have vehicle insurance to cover any type of prospective home damage and also bodily harm that might result from a mishap. Vehicle insurance rates are greatly based upon age, credit, auto make as well as model, driving document and area. Some states even consider sex.

Not known Details About Life Insurance In Dallas Tx

An insurer will certainly consider your residence's place, in addition to the size, age and build of the home to establish your insurance costs. Residences in wildfire-, twister- or hurricane-prone areas will certainly virtually always command greater premiums. If you sell your residence and also go back to renting, or make various other living arrangements (Commercial insurance in Dallas TX).

For people that are aging or impaired as well as need aid with everyday living, whether in an assisted living home or through hospice, lasting care insurance policy can assist take on the expensive prices. This is the kind of point people do not think concerning until they grow older and understand this could be a reality for them, however certainly, as you age you get more information extra costly to insure.

Generally, there are 2 kinds of life insurance policy plans - either term or permanent strategies or some combination of the two. Life insurance companies supply various types of term strategies and traditional life policies in addition to "passion sensitive" items which have actually become next a lot more prevalent considering that the 1980's.

Health Insurance In Dallas Tx Things To Know Before You Buy

Term insurance coverage provides defense for a given time period. This duration might be as short as one year or provide insurance coverage for a particular number of years such as 5, 10, two decades or to a specified age such as 80 or in some instances as much as the oldest age in the life insurance policy mortality.

The longer the guarantee, the greater the first premium. If you pass away throughout the term period, the business will certainly pay the face amount of the plan to your beneficiary.

Report this wiki page